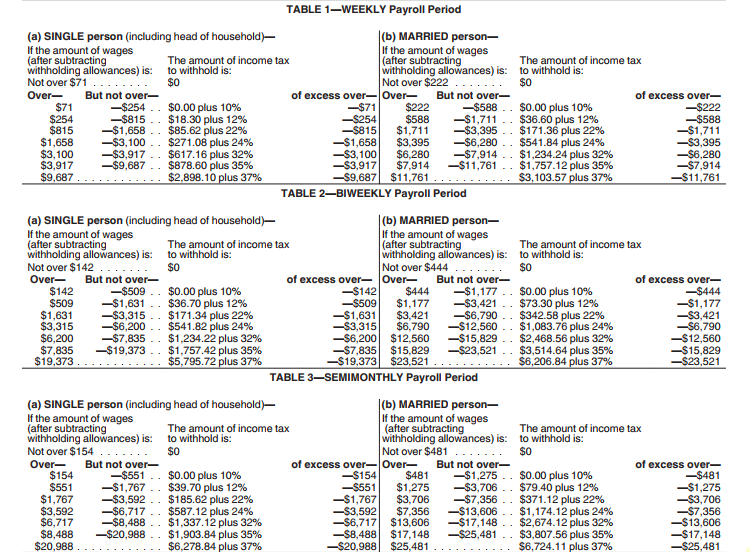

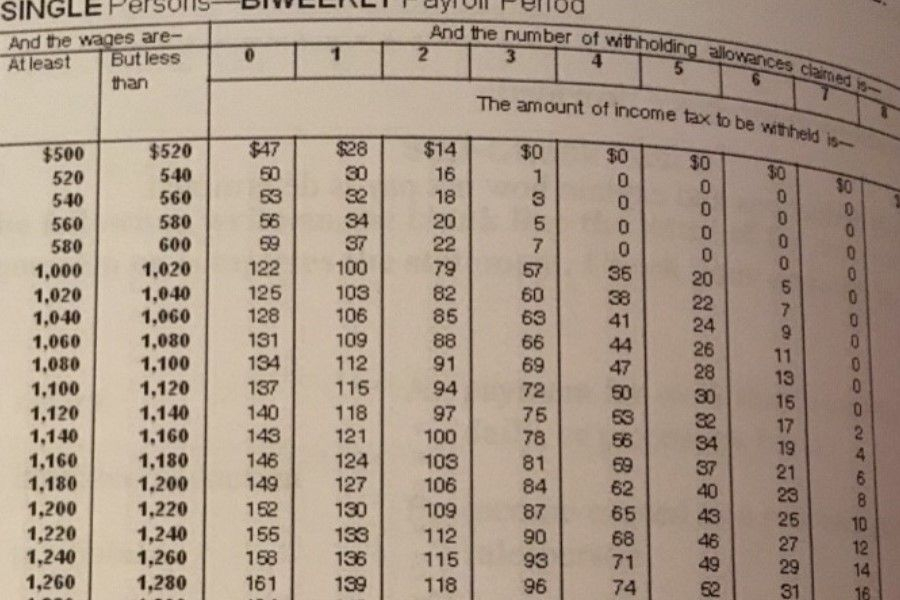

Irs Tax Withholding Calculator 2025. There are two federal income tax. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

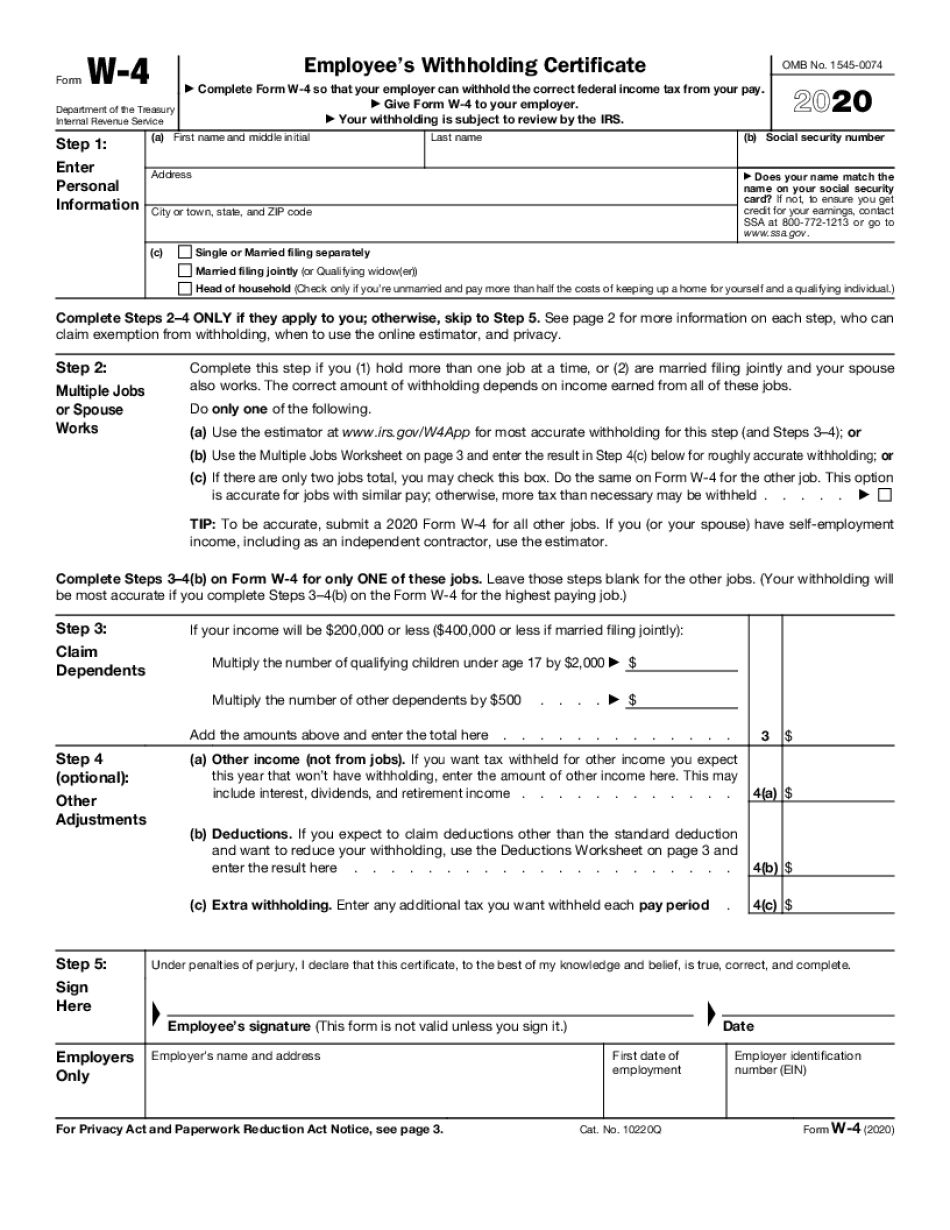

Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure any adjustment to the amount. Enter your income and location to estimate your tax burden.

W4 Withholding Calculator 2025 Perl Zondra, The 2025 tax calculator uses the 2025 federal tax tables and 2025 federal tax tables, you can view the latest tax.

Irs Tax Withholding Calculator 2025 Crissy Genevieve, Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes.

Irs W4 Withholding Calculator 2025 Ninon Marleah, This tax return and refund estimator is for tax year 2025.

W4 Calculator 2025 Irs Aimee Cynthea, Use h&r block's tax withholding calculator to estimate your potential refund.

Irs Tax Withholding Calculator 2025 Ula Lianna, Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure any adjustment to the amount.

Irs Tax Calculator 2025 Excel Faye Orelia, Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes.

Irs Tax Withholding Calculator 2025 Crissy Genevieve, This tax return and refund estimator is for tax year 2025.

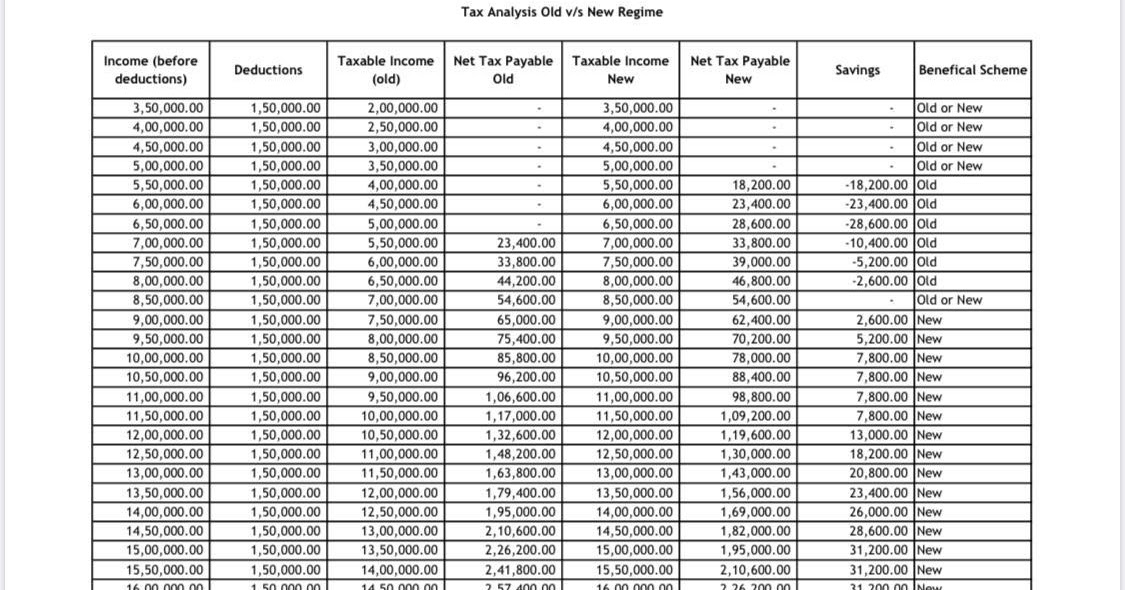

Federal Withholding Tables 2025 Federal Tax, Enter your filing status, income, deductions and credits and we will estimate your total taxes.

Irs Tax Withholding Calculator 2025 Crissy Genevieve, This tax return and refund estimator is for tax year 2025.

2025 Tax Brackets Single Calculator Mandy Lauretta, Use h&r block's tax withholding calculator to estimate your potential refund.